how much is inheritance tax in nc

How Much Is The Inheritance Tax In North Carolina. However there are sometimes taxes for other reasons.

2020 Estate And Gift Taxes Offit Kurman

Does north carolina have an inheritance or estate tax.

. There is no inheritance tax in NC. For example lets say a family member passes away in an area with a 5 estate tax. While north carolinas estate tax was repealed in 2013 other taxes may apply to an.

North Carolina does not collect an inheritance tax or an estate tax. States With No Income Tax Or Estate Tax The states with. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

The current exemption amount for the Federal Estate Tax is 117 million per individual for the year 2021. A surviving spouse is the only person exempt from paying this tax. There is no federal inheritance tax but there is a federal estate tax.

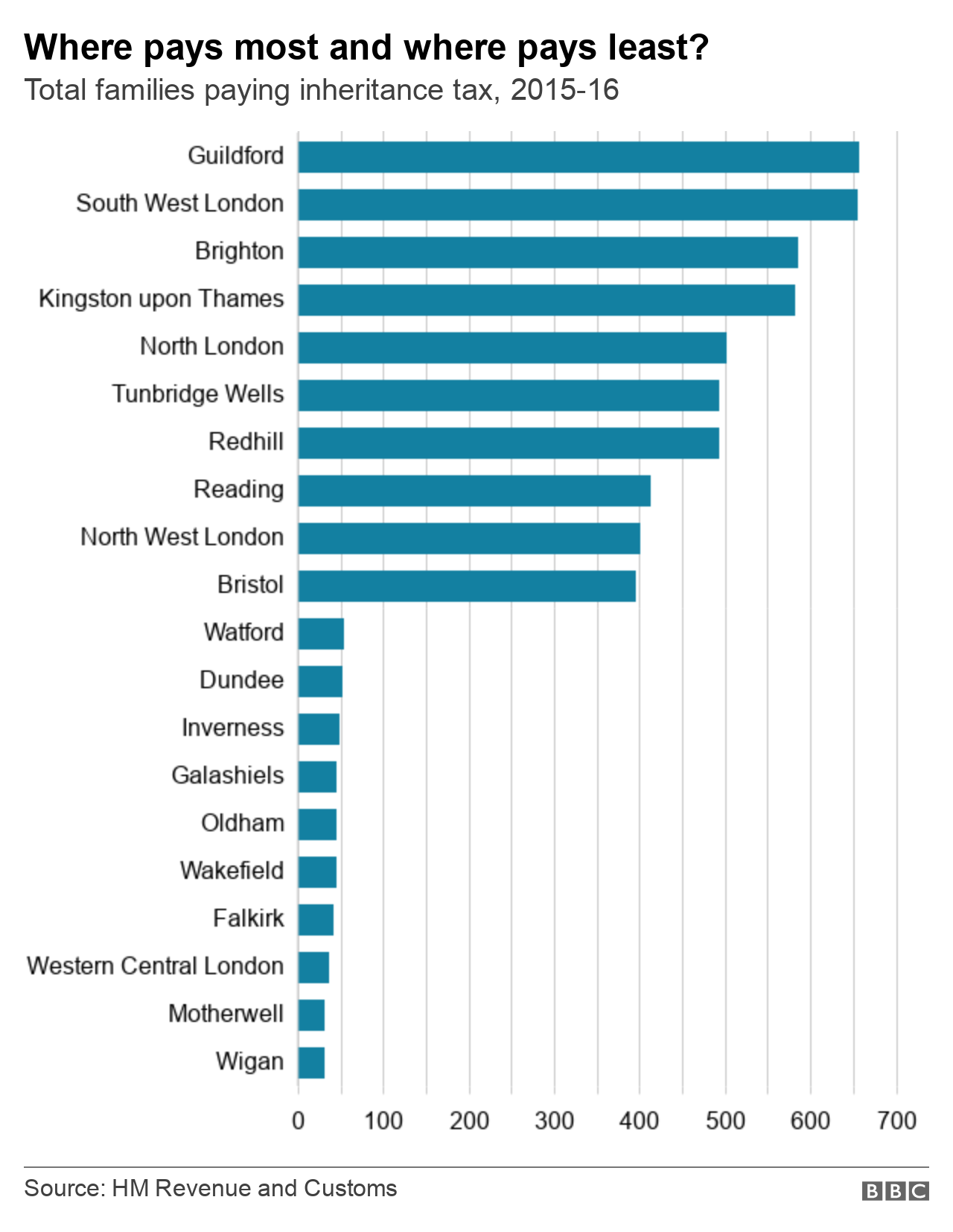

Inheritance Tax in North Carolina. Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. The inheritance tax rate in north carolina is 16 percent at the most according to nolo.

Other forms of retirement income are taxed at the North Carolina flat income tax rate of 525. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. North Carolinas estate tax.

Estate and gift taxes the. The top inheritance tax rate is 16 percent no. All inheritance are exempt in the state of north carolina.

The top inheritance tax rate is 16. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. However there are sometimes taxes for other reasons.

If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all. However state residents should remember to take into account the federal estate tax if their estate or the.

What is the North Carolina estate tax exemption for 2021. If you inherit property. Items included in the.

According to the law an executor can receive up to five percent of the value of the estate for compensation. North Carolina does not collect an inheritance tax or an estate tax. These are some of the taxes you may have to think about as an heir.

However state residents should remember to take into account the federal estate tax if their estate or the. Which states have no estate tax. Inheritances that fall below these exemption amounts arent subject to the tax.

There is no inheritance tax in North Carolina. No Inheritance Tax in NC. Initiatives were floated to repeal Nebraskas inheritance tax and North Carolinas estate tax in 2012 but nothing happened on this front in Nebraska.

The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. However this is five percent of the value after all debts have been paid.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pennsylvania Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Estate Tax Everything You Need To Know Smartasset

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

How To Avoid Estate Taxes With A Trust

401 K Inheritance Tax Rules Estate Planning

How To Calculate Inheritance Tax 12 Steps With Pictures

What To Do And Not Do With An Inheritance

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts Teaching Geography

Federal Gift Tax Vs California Inheritance Tax

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Calculate Inheritance Tax 12 Steps With Pictures

Calculating Inheritance Tax Laws Com

How To Calculate Inheritance Tax 12 Steps With Pictures

North Carolina Estate Tax Everything You Need To Know Smartasset